car sales tax in austin texas

The vehicle identification number VIN. North Highway I-35 Austin TX 78701.

2211 Canterbury St Austin Tx 4 Beds 3 Baths Living Dining Combo Home Values Canterbury

No Haggle Pricing Sell or Trade Home Delivery Warranty Protection Plans Buy Back Guarantee Flexible Financing At Hertz Car Sales we make car financing simple flexible and secure.

. The current total local sales tax rate in Austin TX is 8250. Registration fee base fee of 5075 for passenger vehicles and light trucks Title application fee of 28 or 33 depending on the county State portion of the vehicle inspection fee up to 3075 Local county fees up to 3150 625 vehicle sales tax. Be sure to check in with your local DMV and have the buyer do the same with his or her local DMV branch office for more information on these taxes.

The minimum combined 2022 sales tax rate for Austin Texas is. Austin TX 78752 See Store Hours All Models All Body Styles All Prices View 10063 vehicles Buying a car made better. 4 Cyl 20 L Description.

Multiply the net price of your vehicle by the sales tax percentage. Some dealerships may charge a documentary fee of 125 dollars In addition to taxes car purchases in Texas may be subject to other fees like registration title and plate fees. 29500 5400 24100.

A transfer of a motor vehicle without payment of consideration that does not qualify as a gift is a retail sale and is subject to the 625 percent motor vehicle tax. Sales tax varies by state but overall it will add several hundred or even a thousand dollars onto the price of buying a car. The County sales tax rate is.

The make model and year of your vehicle. Calculate the difference in tax rates 0625 - 04 0225. If you like one of our used cars in the Austin area be sure to make an appointment for your test drive before stopping by.

24100 x 0225 54225. A motor vehicle sale includes installment and credit sales and exchanges for property services or money. The Austin sales tax rate is.

It depends on what the tax rate is in the city where you buy the car. 1568 rows combined with the state sales tax the highest sales tax rate in texas is 825 in the cities. If you purchase a used Honda Civic for 10000 you will have to pay an.

Wayfair Inc affect Texas. Tx sales tax rate. Used cars in Austin TX for Sale 2018 Chevrolet Silverado 1500 LT 29998 114K mi Available at your store CarMax Austin South TX 2020 Tesla Model 3 Long Range 52998 21K mi Available at your store CarMax Austin South TX 2021 Tesla Model 3 Standard Range Plus 50998 5K mi Available at your store CarMax Austin South TX.

Car sales tax in austin texas. A trusted CarMax partner find your service shop At this store Store hours for Mar 24 Open now. Calculate the amount subject to tax.

CityCountyother sales tax authorities do not apply. Provide proof of sales tax paid by submitting the itemized bill of sale along with 54225. Did South Dakota v.

Sales and Use Tax. The date the vehicle entered or will enter the state you plan to register it in. State collected 4 sales tax.

Lakeway TX 12 miles from Austin TX Mileage. Remember to convert the sales tax percentage to decimal format. North Interstate 35 Austin TX 78753.

New texas residents pay a flat 9000 tax on each vehicle whether leased or. These locations operate as Avis rental locations and only have Ultimate Test Drive vehicles on request. State sales tax is 625 percent and based on the standard presumptive value spv.

The 2018 United States Supreme Court decision in South Dakota v. Used 2020 Lexus UX 200 with FWD Roof Rack Keyless Entry Spoiler Roof Rails 18 Inch Wheels Alloy Wheels Lane Departure Warning Heated Mirrors Satellite Radio and Lexus Enform. Any mileage 10000 or less 843 20000 or less 2074 30000 or less 3557 40000 or less 4989 50000 or less 6344 60000 or less 7426 70000 or.

Most states do not have taxes governing the sale of vehicles but the buyer may have to pay state taxes in order to bring the new vehicle into his or her home state. Motor vehicle sales tax is due on each retail sale of a motor vehicle in Texas. For example if your state sales tax rate is 4 you would multiply your net purchase price by 004.

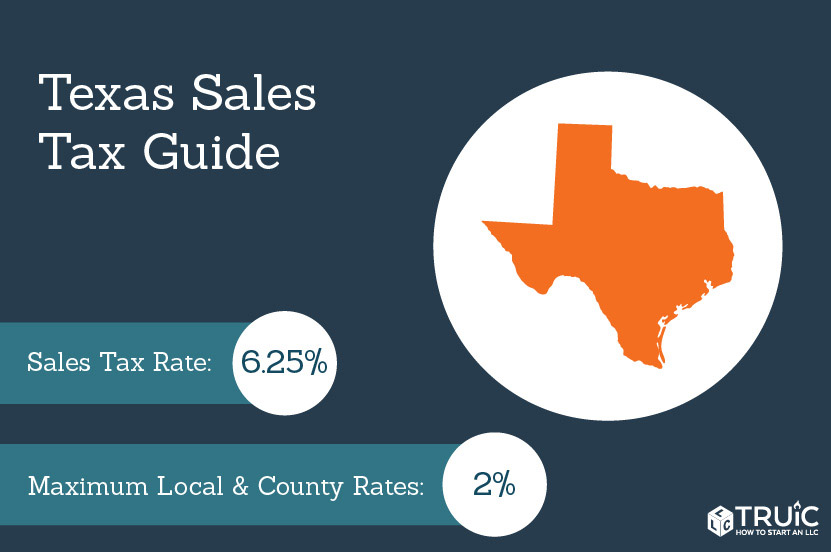

Texas collects a 625 state sales tax rate on the purchase of all vehicles. This means that depending on your location within Texas the total tax you pay can be significantly higher than the 625 state sales tax. For example sales tax in California is 725.

Autotrader has 18706 Used for sale near Austin TX including a 2018 Audi A3 20T Premium Plus a 2018 Audi A4 20T Ultra Premium w 18 Wheel Package and a 2018 Audi Q5 20T Premium Plus w Premium Plus Package ranging in price from 3042 to 1300000. The information you may need to enter into the tax and tag calculators may include. If you are legally able to avoid paying sales tax for a car it will save you some money.

IH 35 Austin TX 78745 Call center 512 3625945 Find another store Important to know. Closes at 9PM Car lot showroom hours Monday Friday 10AM9PM Saturday 9AM9PM Service repair hours Monday Friday 730AM6PM 4400 S. Completed Application for Texas Title andor Registration Form 130-U The following fees.

The Texas sales tax rate is currently. Come find a great deal on used Cars in Austin today. 4 rows Austin TX Sales Tax Rate.

Overdue Tax Interest Rates. The Texas Comptroller states that payment of motor vehicle sales. This is the total of state county and city sales tax rates.

The sales tax for cars in Texas is 625 of the final sales price. Sales tax on a car purchase in Texas is 625 regardless of where you buy it. Search over 48363 used Cars in Austin TX.

We bought a new car in Round Rock two weeks ago and it was 625. Multiply by the amount subject to tax by the new tax rate. 4269 miles Body Style.

While tax rates vary by location the auto sales tax rate typically ranges anywhere from two to six percent. You can find these fees further down on. TrueCar has over 836531 listings nationwide updated daily.

The date that you purchased or plan to purchase the vehicle. Texas has a 625 statewide sales tax rate but also has 982 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 1678 on top of the state tax.

Texas Used Car Sales Tax And Fees

Texas Car Sales Tax Everything You Need To Know

Pin On Austin From Austinwoodandmetal Com

1111 W 9th St Austin Tx 78703 Mls Czdxc8 Zillow House Exterior Austin Real Estate Austin Homes

3102 Perry Ln Austin Tx 4 Beds 2 Baths One Story Homes House Styles Modern Farmhouse

1121 Brookswood Ave Austin Tx 1 Bath One Level Homes Level Homes The Neighbourhood

2725 Barton Skwy Austin Tx 3 Baths Modern House Home Exterior Brick

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

Austin Tax Season Car Deals For Kia

715 E 43rd St Austin Tx 3 Beds 3 Baths Sale House Outdoor Mother S Cafe

Texas Sales Tax Small Business Guide Truic

Sales Tax On Cars And Vehicles In Texas

1511 W 29th St Austin Tx 2 Baths Home Fee Simple Musashino

800 Brazos St 704 Austin Tx 1 Bed 1 Bath In 2021 Home Photo Redfin Royal Blue Grocery

Pass Through Garage House Design House Designs Exterior Houses In Austin

Austin City Skyline Bee Creek Photography Skyline Austin Skyline City Skyline

Down Under Auto Sales Homepage Used Car Dealership Austin Tx Homepage